- Refining VC

- Posts

- VCs Are Getting LinkedIn Wrong (And LPs Can Tell)

VCs Are Getting LinkedIn Wrong (And LPs Can Tell)

The trust/signal problem that makes VC content uniquely difficult

I’ve had lots of questions following last week’s post recapping the year so far in VC content.

Most of them have been around one thing… LinkedIn.

As well as this, I get pitched constantly by ghostwriters who already run successful Linkedin accounts. They follow proven formats - hook-driven narrative, clear formatting, strong CTA, 4 posts a week. Job done.

Many want to work with VCs... I assume because it's perceived as interesting or high-status.

The bad news, it just doesn't work. It's very, very different.

Why trust me?

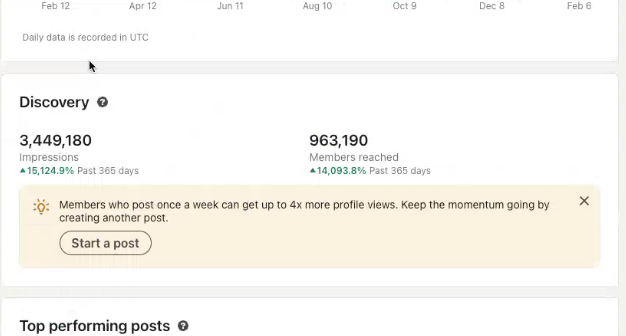

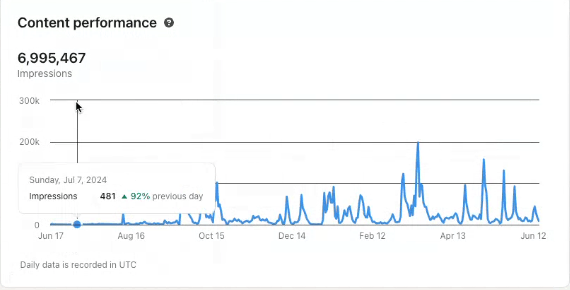

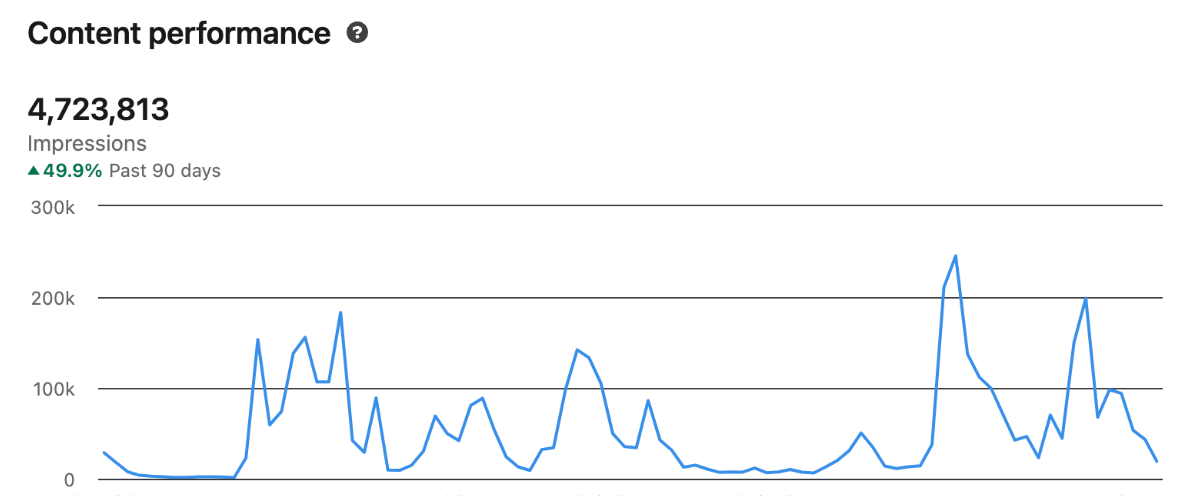

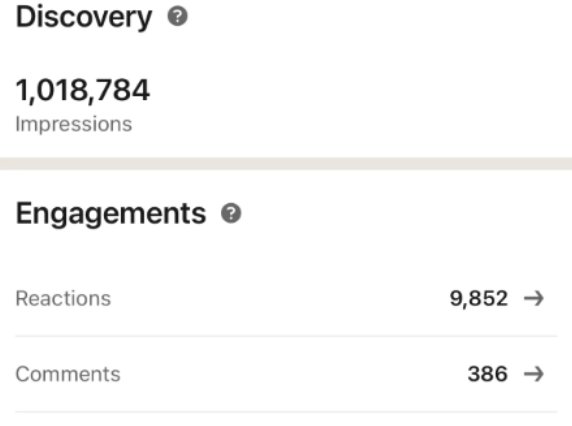

Over the last several years, have grown multiple accounts into generating millions of impressions.

|  |

|  |

But more importantly, by only serving VC related accounts, we can post only relevant content, avoiding generic because we deeply understand the actual goals in mind:

Capital in (LP commitments)

Capital out (portfolio growth → exits)

Everything else is vanity.

The Think Boi Problem

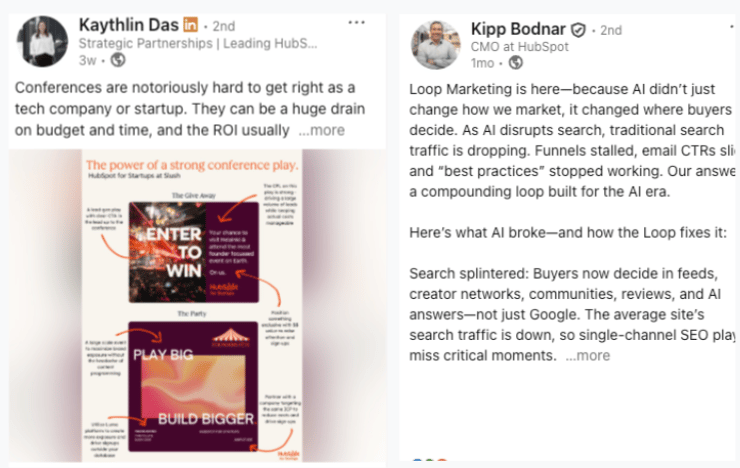

You might think you can just apply standard LinkedIn playbooks (this kinda thing).

These are usually touted by B2B influencers or lead-gen gurus.

If I can immediately tell when people are applying these generic playbooks to VCs, so can LPs or sophisticated founders.

Maybe these help drive in engagement… but being viewed as generic by an LP or Founder is likely more damaging than not posting… (sorry if you got caught in the crosshairs of my morning scroll).

|  |  |

Likewise, the aggregation playbook (where you simply share news for news sake) with no comment or relation back to who you actually are.

These are problematic for VCs to enact because VC is plagued by a hugely high bar for quality.

Generic LinkedIn advice optimises for maximum reach / engagement. But VCs don't need 100K followers. You need the specific LPs who might allocate to you, the specific founders in your niche or the specific operators who might refer dealflow.

The defining voices of the industry are elite thinkers and communicators - a convergence of strategic necessity and inherent expertise. This creates a problem for average and below communicators.

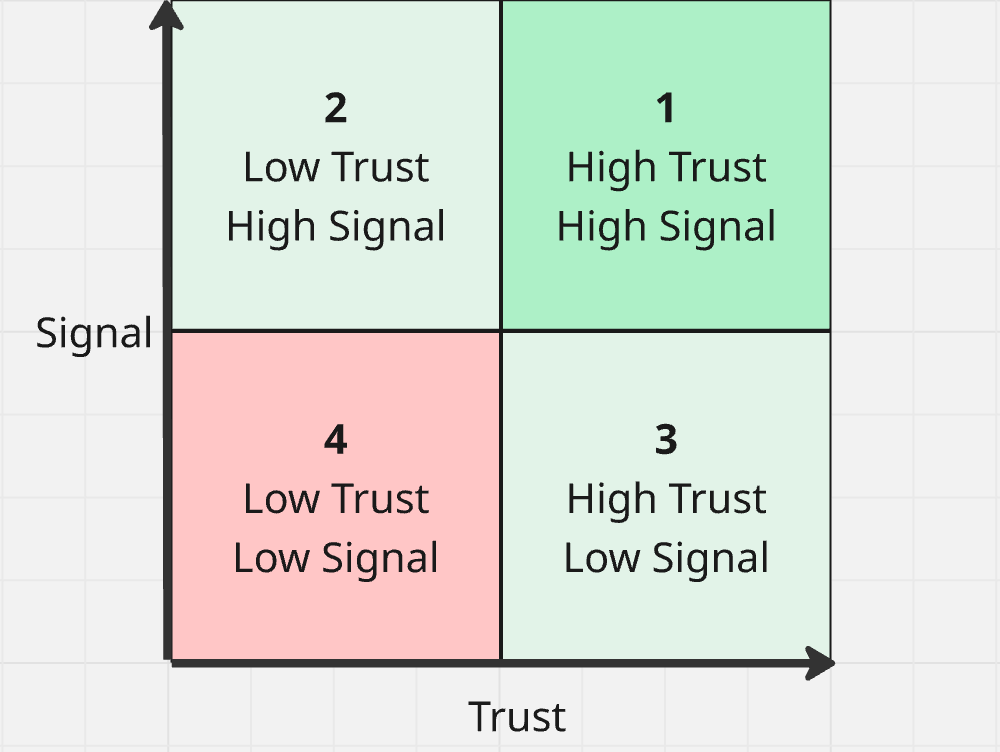

The Trust/Signal Matrix

1: High Trust, High Signal: Portfolio learnings with real data, tactical frameworks that work, specific insights from your position. You're genuinely trying to help and the information is valuable.

2: Low Trust, High Signal: Salesy content, lead magnets, "DM me to learn more." The information might be useful but the motive is obviously transactional.

3: High Trust, Low Signal (top left): Personal stories, "here's my journey," motivational content. Genuine but less actionable insight.

4: Low Trust, Low Signal (bottom left - RED): AI slop, engagement bait, generic recycled content. Neither trustworthy nor useful.

This is really hard. but VCs need mostly be top-right, however 2 & 3 can serve specific goals (audience building, newsletter list building, personal brand building etc etc).

With the bar for quality being so high, typically budgets for VC content often don't match what's required in terms of skill, or if they do, many agencies don’t match the domain depth for the je ne sais quoi required in VC content.

Tbf for creators/agencies this is a hard domain to be working in. (For my sins, I’m here)

The underlying reason for this is… Content for VCs is less about ‘leads’ and more about perception.

I believe we actually retain our clients less so because of metrics but more so because perception show up as lived evidence… While anecdotal is hard to measure, VC is a highly relational game, we know what we do is working when the below is regular…

LinkedIn —> Capital In

LinkedIn —> Capital Out

How VCs Deliver Signal on LinkedIn

The number one trick to generating inbound interest is to be known for being the ‘go to person’ on a topic (your firm these or partner vertical).

Content for Linkedin are roughly two directions:

Outward-facing: Commentary on the world. Market takes, trend analysis, reactions to news, data visualisation, memes about the industry.

Most VCs default to outward-facing because it feels safer. Hot take on AI. Chart about market trends. Meme about founder behaviour.

This can work if you have a knack for it - reading the room, timing, knowing what will resonate. Some people are naturally good at this.

The problem: outward-facing content is high competition. Everyone has takes on the same trends. Your opinion on the latest AI model competes with thousands of other opinions. Unless you have unique data or genuine insider perspective, it's just noise.

Inward-facing: Your own process. What you're learning from portfolio, how you make decisions, frameworks you actually use, patterns you're seeing.

Inward-facing content is where small VCs have an advantage.

Nobody else can write about your specific portfolio learnings. Nobody else makes decisions the way you do. Nobody else has your operating scars applied to your investment focus.

The inward-facing stuff is harder because it requires you to have something worth saying.

But that's exactly why it works. It's high signal / can't be commoditised.

A previous piece looked at How to Extract Uniqueness for Content from your firm but it is worth addressing specifically those Inward / Outward takes…

For inward-facing content:

Partner interviews monthly. 30 minutes. Ask questions around Patterns seeing/ Decisions made… Record it, transcribe it. You now have unique raw material tied to authentic voice.

Investment memos as content. You already wrote why you invested. Six months later, convert parts into "here's what we were thinking / here's what we've learned since."

Building the firm in public. How you make decisions, what you're learning, why you structured something a certain way. It also forces introspection and articulating the 'why' behind decisions. We always encourage partners to do this.

For outward-facing content:

Swipe file of news + voice notes. Keep running doc of articles/trends where you have actual perspective, if you're just repeating news, skip it.

24-48 hour window. If commenting on news, you have 24-48 hours before everyone's said it and the window closes.

Tie outward to inward when possible. Not "AI is changing everything." Better… "We're seeing [specific pattern]. Here's what it means for [specific application]."

The Low Hanging Fruit

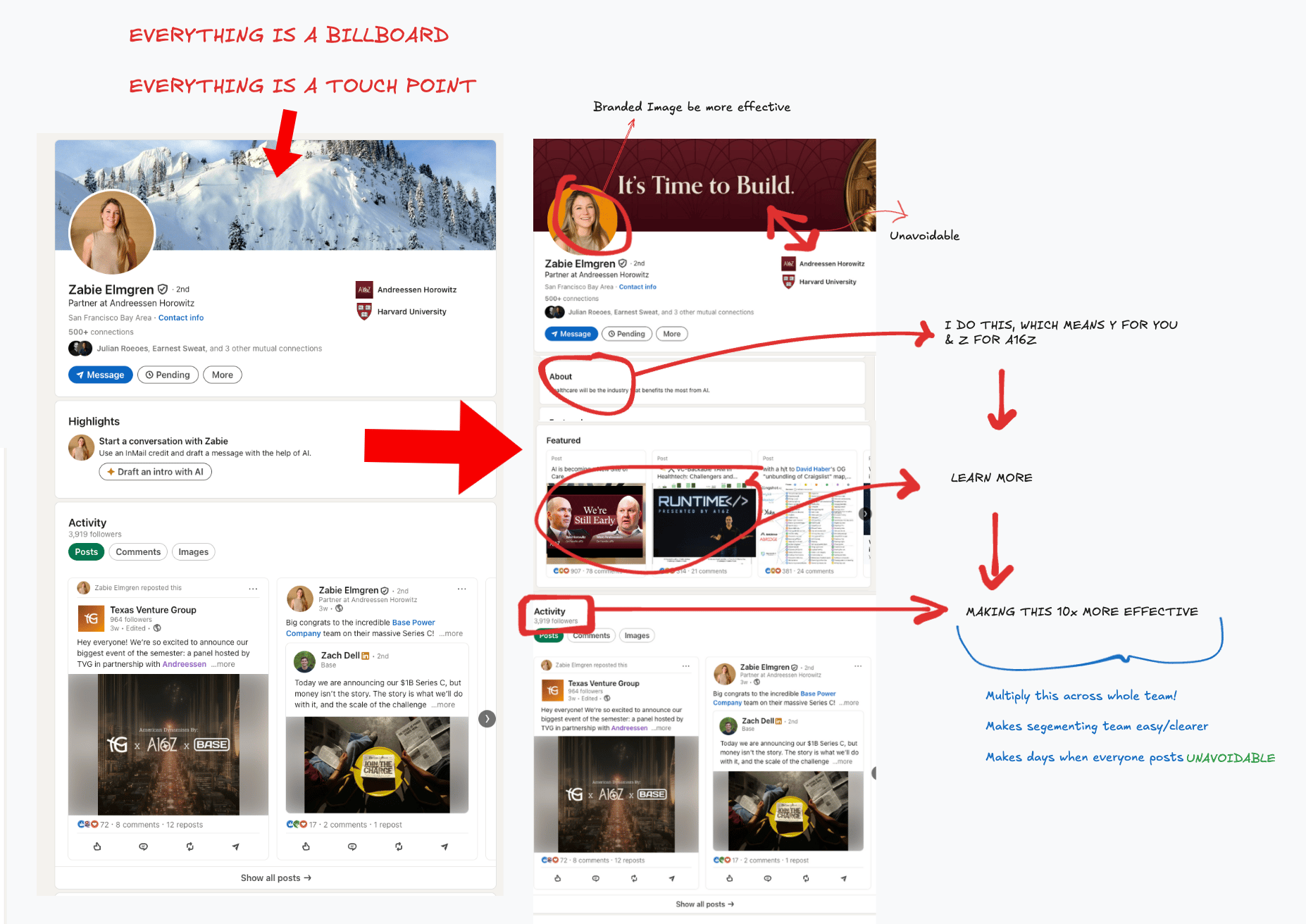

But before you begin it’s worth highlighting how many VC profiles don't have basic optimisation.

The common problems:

Generic headline: "Partner at [Fund Name]" This tells me nothing. What do you invest in? What stage? What makes you different.

About section blank or is your resume: "John has 15 years of experience..." Nobody cares about your resume. Tell founders: what you invest in, what you help with, how to reach you.

No featured section (or just press mentions): Prime real estate wasted. Feature your best content. Portfolio learnings, tactical frameworks, anything demonstrating expertise.

Here’s an example, sorry Zabie…

This matters beyond individual profiles:

Profile optimisation is a multiplier. If you have 5-10 people at your fund all posting, and their profiles are optimised, every piece of content becomes more effective.

When someone sees a post that resonates and clicks through to a well-optimised profile, they immediately understand:

Who this person is

What they focus on

Whether they're relevant

How to reach them

Without optimisation, you're burning attention. People click through, find a generic profile, and leave.

The "everywhere" effect:

LinkedIn released their 2025 algorithm update emphasising authenticity and clear identity. They want to understand who people are.

When your entire team has optimised profiles with clear verticals, and everyone posts on the same day about a major announcement, it creates an "everywhere" effect.

For example, we worked with a Fund announcing a $500M close. Instead of just the fund account posting, we unique individual assets for ~30 people across the team to post the same day. Even people in smaller roles amplifying the message. With optimised profiles, this looks incredibly strong.

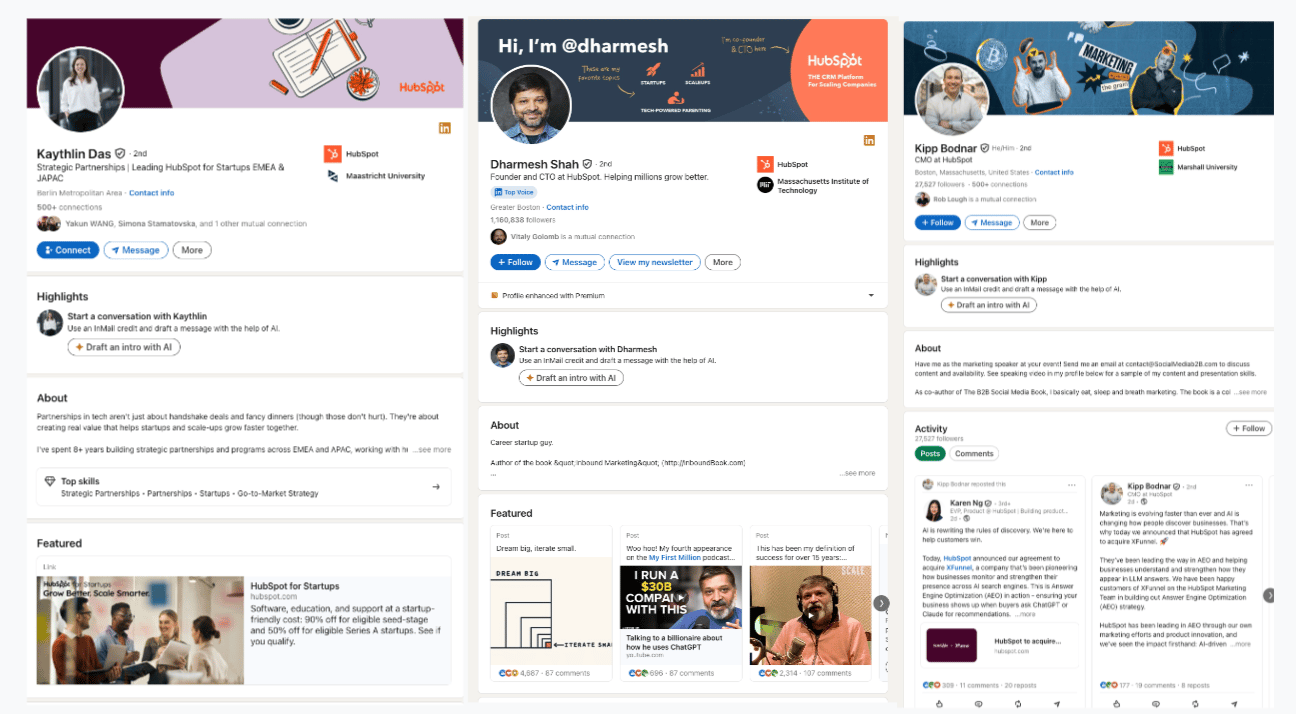

Outside of VC…. HubSpot does this exceptionally well. You can imagine how this applies to your firm.

Dharmesh (CEO) posts about leadership and company, Kipp (CMO) posts about marketing and Kaythlin (startup lead) posts about conferences and early-stage. Each has super-optimised profile tied to HubSpot. When they coordinate, it compounds across the whole team.

Segment team into clear verticals (X or Y investment vertical team, platform team, HR etc.)

Optimise every profile with: clear headline with vertical, about section explaining focus/value, featured fund/personal content, contact method

Create content assets by vertical (investment announcements, reports, insights)

Build workflows e.g. When we invest, these are the assets we need —> This is how we add personal takes —> This is how we multiply across team.

The Takeaway

Building both the content muscle, and the impressions is slow. Especially if you are at a smaller fund. Anyone promising faster is likely optimising for vanity metrics.

But lean into the fact that you (or your partners) are already domain experts. Good content only extracts your thinking. You likely just need content skills or systems to extract this effectively - both are learnable or hireable.

From there, the only differentiation is consistency. Most VCs won't do it because it's hard.

Lastly… This might not be for you… as ever, lean into your specific content style with our GP Content Fit Matrix.

A* VC content isn’t about volume, but clarity of signal - proof that you see the world differently and have the receipts to back it up.

The firms that treat communication across all platforms, including LinkedIn, as infrastructure (core to their process) will dominate the next cycle.

Laurie, Refinery Media

If you made it all the way through, thanks so much for reading! Several hundred VCs now open this every week. If it’s helped you think differently about marketing, Venture, or storytelling, please send it to someone in your orbit.

If you enjoyed this read more from our top posts: