- Refining VC

- Posts

- What is your reputation?

What is your reputation?

Building the highest-returning asset you'll ever develop

In venture capital, everyone talks about compounding returns on capital.

Few discuss the compounding returns on reputation.

Yet in a business built on trust, access, and influence, your reputation might be the highest-returning asset you'll ever develop - appreciating in value over decades (and it requires zero management fees).

The Mathematics of Trust

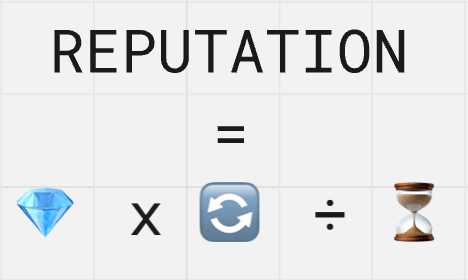

The fundamental equation of venture capital reputation is deceptively simple:

Reputation = (Quality × Consistency) ÷ Time

This explains why:

A single exceptional investment doesn't create lasting reputation

Sporadic brilliance gets forgotten between appearances

New funds must overcome the denominator of time

But it also reveals the strategy:

When quality and consistency remain high, time works in your favour rather than against you. Each year adds compounding value to your reputation rather than diluting it.

From Security to Opportunity

At its core, reputation serves a primal human need: security.

Founders seek the security of knowing their investors won't abandon them in tough times. LPs want the security of entrusting capital to managers who deliver on promises. Employees want the security of joining a firm with enduring values.

But reputation extends far beyond security. It creates opportunity:

Founders bring you deals before others see them

Other investors invite you into their best rounds

Talent joins your team more readily

Media amplifies your perspective over competitors

LPs increase allocations despite market conditions

Each ‘reputational deposit’ creates multiple new opportunities, which themselves create further reputation-building moments.

By the way… we were featured on a Beehiiv blog below - where we spoke about newsletters as trust building. Check it out below!

The Three Layers of Reputation

VC reputation operates at three levels, each with different compounding rates:

Layer 1: Reliability - Simply doing what you say you'll do This is the foundation: returning LP capital, supporting portfolio companies as promised, maintaining consistent investment pace.

Layer 2: Judgment - Making good decisions that create positive outcomes This is what most associates with reputation: picking winners, adding value to companies, navigating complex situations effectively.

Layer 3: Character - Operating with integrity, especially when it costs you. This is the highest level: maintaining your values when incentives push against them, treating people well even when there's no immediate benefit.

The compounding dynamics vary dramatically across these layers. Reliability compounds linearly. Judgment compounds exponentially. Character compounds eternally.

Content as Reputation Currency

Building reputational compound interest requires a shift from thinking about grand gestures to consistent deposits.

Your content strategy - what you write, share, and publish - serves as public reputation currency.

Each piece either makes a deposit or a withdrawal from your reputational account.

The most effective approach treats content not as marketing but as evidence:

Evidence of your thinking quality

Evidence of your domain expertise

Evidence of your values and character

Evidence of your consistency

When your content aligns with your actions, it creates a powerful reinforcement effect. When it doesn't, it creates credibility gaps that undermine trust.

The most sophisticated content strategy understands that personal and firm reputations are inseparable.

While institutional brands provide stability, human connections create the emotional resonance that drives lasting reputation. People trust people first, institutions second.

This doesn't mean partners should become performative personalities. It means they should authentically represent the firm's values, expertise, and approach - creating consistent experiences that reinforce rather than contradict each other.

Your Reputation Audit

To assess your current reputational position, ask these questions:

If we disappeared tomorrow, what would the founders miss most about us?

What one word would founders use to describe working with us?

When we pass on deals, do founders still speak well of us afterward?

Do we have a specific promise we're known for keeping?

Are there inconsistencies between different partners' behavior?

Does our content reflect who we actually are, or who we aspire to be?

The answers will reveal both your reputational strengths and the gaps where deposits are most needed.

The most valuable aspect of reputational compound interest is that it accelerates over time.

A new fund might need to make daily deposits for years before seeing significant returns. An established fund with decades of consistent behavior enjoys automatic reputation generation - their history creates presumptive trust that new entrants must earn from scratch.

This means the earliest years are the most critical. The reputation you build in your first fund will compound - positively or negatively - through every subsequent fund.

So don't wait until you have "more bandwidth" to focus on reputation. It may be the highest-returning investment you'll ever make.

Laurie, Refinery Media

If you made it all the way through, thanks so much for reading! Several hundred VCs now open this every week. If it’s helped you think differently about marketing, Venture, or storytelling, please send it to someone in your orbit.