- Refining VC

- Posts

- The Venture Content Playbook

The Venture Content Playbook

How Venture Capital and Private Equity Funds can leverage content from the hard work they are already doing.

So… Why "Refinery"?

I get this question from time to time.

Usually from a fund partner who's just finished telling me about all the insights trapped in their Slack channels, voice notes, and investment memos that somehow never make it out into the world.

The answer is pretty simple.

An oil refinery - that great monument to industrial modernity - takes raw, messy crude oil – useless in its natural state – and transforms it into something valuable: jet fuel, petrol, plastics, and hundreds of other products we use every day.

The refinery doesn't create anything new.

It just applies heat, pressure, and specialised processes to extract what's valuable and make it usable.

That's exactly what we do with a fund.

Most funds are sitting on an untapped reservoir of raw material:

Partner insights from IC discussions.

Market analyses from DD.

Founder advice shared in portfolio meetings.

Wisdom captured in call recordings or Slack.

Frameworks used internally to evaluate opportunities.

This material is immensely valuable but often trapped in formats that aren't accessible or usable for external audiences.

It's the "crude oil" of your firm - full of potential value, but not yet refined for consumption.

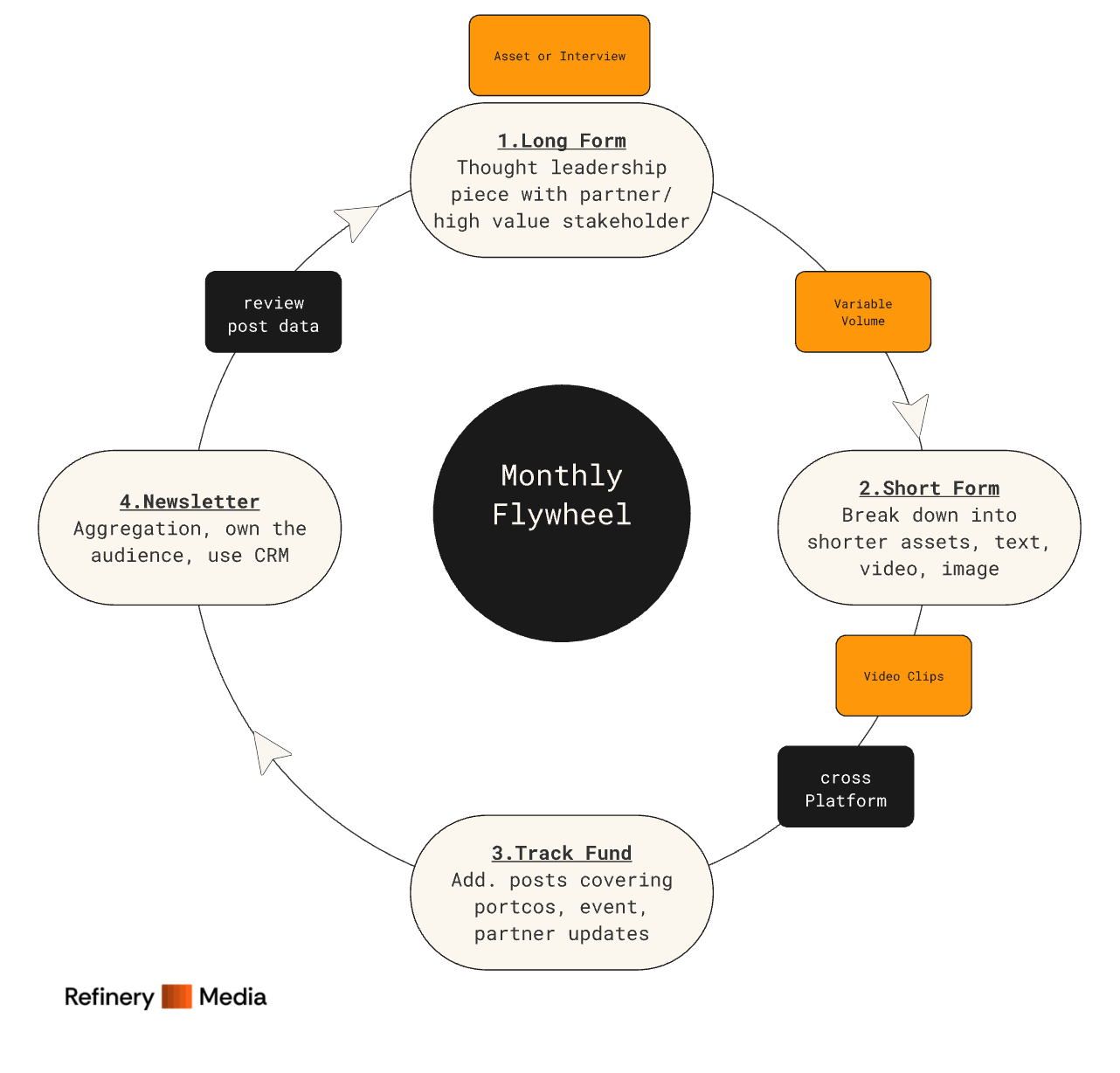

The Monthly Flywheel

There isn’t a one size fits all. But from now working with 15+ funds, there is a common thread with how funds operate that means some generic advice is applicable.

Your content approach should be thought of as a flywheel.

Because without 1. Consistency and 2. Momentum there is little point.

Start with the Deep Stuff

Start with one substantial piece of thinking. This is the real expertise that makes your firm ‘special’.