- Refining VC

- Posts

- How to Make Your Value More Tangible

How to Make Your Value More Tangible

The gap in the market for funds to turn their strategic thinking into visual assets.

Our brains process visual information 60,000 times faster than text, and research shows that concepts presented visually are retained at rates up to 65% higher than text alone.

If you're not prioritising visual communication, you're missing 95% of your potential impact.

The venture capital industry faces a unique challenge:

80% of what you deliver is intangible. Your expertise, pattern recognition, founder support, network connections, strategic guidance - none of these are physical assets you can point to.

As venture capital has professionalised, founders now have higher expectations for clarity and transparency.

But most VC communication remains stubbornly text-heavy (dense websites, process descriptions, linear slide decks)

I think there is a huge gap in the market for funds to turn their strategic thinking into visual assets.

And translate their mental models into frameworks that can be shared, remembered, and applied.

The Visual Strategy Hierarchy

For VC firms, visual articulation of strategy operates at three levels:

Level 1: Visual Identity

This is where most firms stop - a logo, consistent colours, and typography. These are table stakes (but can be differentiators if done v v well).

Level 2: Visual Explanation

Transforming complex processes and criteria into diagrams, frameworks, and models. This is where clarity begins to emerge, showing how you think rather than just what you think.

Level 3: Visual Thinking

Developing proprietary frameworks that represent your firm's unique approach to markets, opportunities, and value creation. These become intellectual property that defines your brand.

From Theory to Practice

Consider the typical founder experience with VC websites:

They visit 20 different sites, each with nearly identical language about being "founder-friendly," "hands-on," and "value-add." The words blur together. Nothing stands out.

Now imagine a founder encountering your visual thesis - a clear framework showing exactly how you think about their market, where you see opportunity, and how you support companies at different stages.

The contrast is immediate. Where other firms tell, you show. Where they claim, you demonstrate.

NFX transformed the abstract concept of "network effects" into a clear visual hierarchy

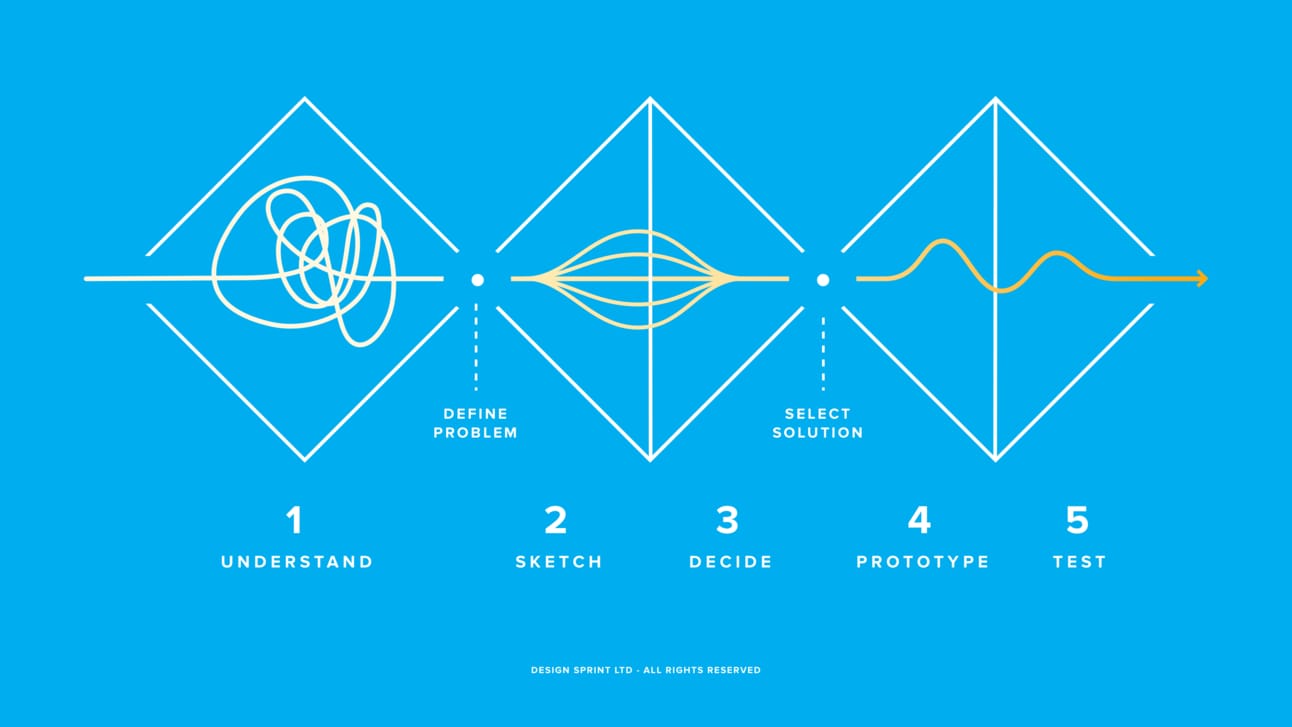

GV successfully co-opted Google's Design Sprint methodology as a visual framework

Park Rangers Capital transformed their entire investment thesis into the "Elephants vs Unicorns" metaphor - complete with animal characteristics that map to startup traits (thick skin = weathering tough markets, travel in herds = community-first approach, empathetic = listening to members). This visual metaphor makes their community-focused investment philosophy immediately memorable and shareable.

Likewise, Boost VC pioneered the "Be the Cockroach" concept back in 2015 - positioning startups as resourceful survivors who "won't die" no matter what, long before the current wave of alternative-to-unicorn thinking.

The metaphor examples are particularly strong because they creates an entirely new mental model that founders can easily grasp and remember. When someone says "cockroach company," you immediately understand the longevity over rapid growth focus.

Starting Your Visual Strategy

You don't need to be a designer to begin thinking visually. Start with these steps:

Identify abstract concepts that are core to your investment approach

Map relationships between key elements of your decision-making

Look for metaphors that represent how you think about markets or opportunities

Capture conversations by sketching simple frameworks during meetings

Test and refine based on how effectively others grasp your thinking

What complex ideas do we repeatedly explain?

Your investment criteria, due diligence process, and support methodology are all candidates for visual frameworks.

What relationships between concepts are critical to our approach?

Market dynamics, founder/market fit assessments, and portfolio construction principles all benefit from visual articulation.

What transformations do we help create? The before and after of working with your fund.

This week, identify one complex idea central to your firm's approach. It could be your investment thesis, decision framework, or support methodology.

Sketch a simple visual representation of this idea.

Share it with someone outside your industry. If they can grasp the concept in seconds, you've successfully begun the visual engineering process.

Over the summer, we've been collaborating with a UK growth fund to develop their visual strategy - turning abstract investment concepts into memorable frameworks and assets. We're taking on one final project this quarter. If you're tired of looking like every other fund and want to create visual thinking that becomes your calling card, we should talk.

Laurie, Refinery Media

If you made it all the way through, thanks so much for reading! A few hundred VCs now open this every week. If it’s helped you think differently about marketing, Venture, or storytelling, please send it to someone in your orbit.